A new report indicates a significant power shift in the Austin real estate market, with the number of sellers now far exceeding the number of available buyers. This surplus of inventory has officially tipped the scales, creating what one real estate firm is calling the strongest buyer's market in the entire country.

For prospective homeowners, this change brings more negotiating power and a wider selection of properties. However, for sellers, it signals a more competitive environment where pricing and property condition are more critical than ever.

Key Takeaways

- Austin has been identified as the top buyer's market in the United States, with 130% more sellers than buyers.

- The abundance of housing inventory, fueled by new construction, is giving buyers the upper hand in negotiations.

- Despite lower sale prices, high mortgage rates, insurance, and property taxes remain significant cost factors for buyers.

- Approximately 15% of home sale contracts in Austin were canceled in September, often after property inspections.

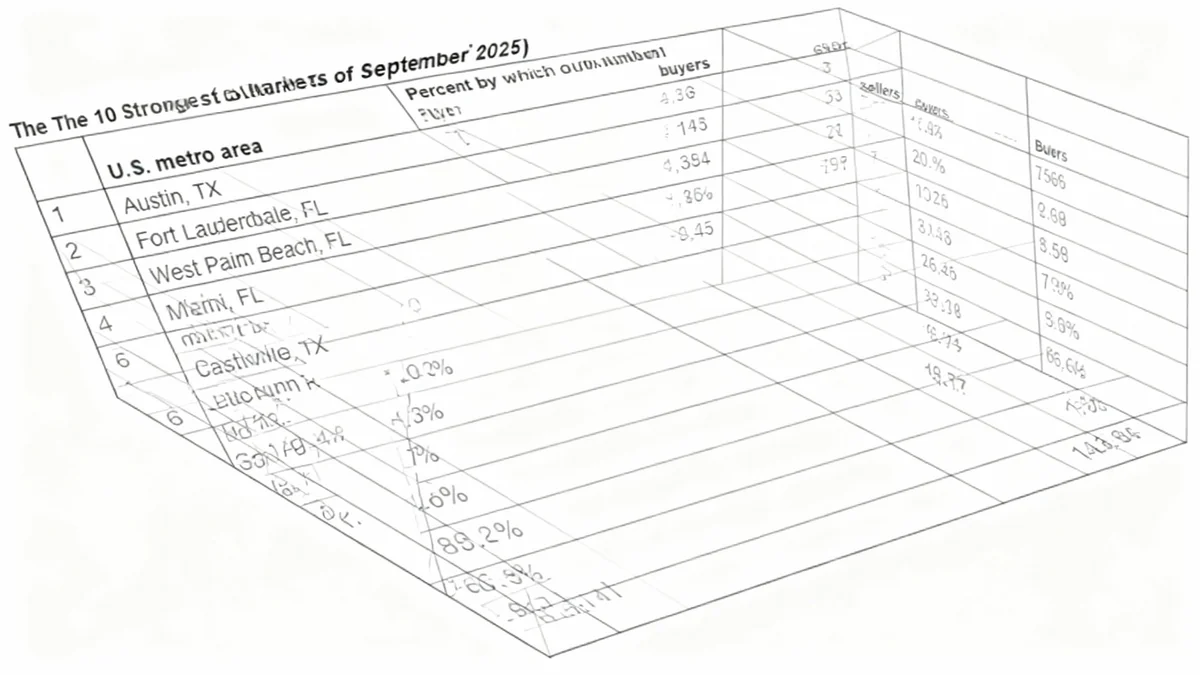

- Other major Texas cities, including San Antonio, Dallas, and Houston, also rank among the top ten buyer's markets nationally.

A Dramatic Shift in Market Dynamics

The Austin housing landscape has undergone a remarkable transformation. Once a fiercely competitive seller's market characterized by bidding wars and rapid price appreciation, it now leads the nation in conditions favorable to buyers. A recent analysis by real estate company Redfin revealed that the city has 130% more active sellers than buyers, a stark contrast to previous years.

This imbalance grants buyers a level of influence they haven't seen in over a decade. "Where there’s 130% more sellers than there are buyers, buyers really do have considerable amount of power," explained Chen Zhao, Redfin’s head of economics research. This surplus means more choices and less pressure to make rushed decisions.

According to Zhao, this environment is expected to keep prices stable or even lead to decreases. "We do expect to see that prices are actually flat or that they’re dropping. And that means that buyers are seeing more affordability than they were a year ago," she added.

Texas Dominates Buyer's Market List

Austin isn't the only Texas city where buyers have an advantage. San Antonio, Dallas, and Houston also appeared in the top ten list of strongest buyer's markets, indicating a broader trend across the state.

The Impact of New Construction

A primary driver behind this market shift is the surge in new construction that Austin has experienced over the past few years. This boom significantly increased the housing supply, directly contributing to the current inventory surplus.

"A lot of the reason why Austin is in this position is because there was a lot of new construction in Austin, and that really added to the amount of supply," Zhao noted. This influx of new homes has given buyers more options, forcing existing homeowners and builders to compete more aggressively for their attention.

However, this construction wave may be cresting. Data on new building permits and housing starts shows a slowdown, suggesting that the current peak inventory levels may not last indefinitely. "There’s less new construction that will be rolling out in the future," Zhao said. "Looking forward, buyers may not necessarily have as much power as they do right now."

Challenges Remain for Homebuyers

While a buyer's market presents opportunities, it doesn't eliminate all financial hurdles. The initial sale price is only one part of the homeownership equation. Buyers must still contend with other significant expenses that impact overall affordability.

Beyond the Sticker Price

Experts caution buyers to look at the complete financial picture. After a price is negotiated, the total monthly cost can be a surprise. This includes mortgage payments influenced by current interest rates, homeowners insurance premiums, and local property taxes, which can be substantial in Texas.

"After [buyers] have struck a deal, they have to go apply for a mortgage, then they actually see how much it’s going to cost on a monthly basis. They have to get insurance, perhaps. They are going to be looking at how much property taxes are going to be, and sometimes that total bill is maybe less friendly than they would have imagined."

These additional costs can strain a buyer's budget, even if they secure a favorable purchase price. This financial reality is also contributing to a higher rate of canceled sales contracts.

A Rise in Canceled Contracts

The newfound power for buyers is also evident in the number of deals that fall through before closing. Recent data shows that approximately 15% of home sales in Austin were canceled in September. This rate has remained consistently high in recent months.

Most of these cancellations occur after the property inspection phase. With more options available, buyers are less willing to overlook potential issues. If an inspection reveals problems, buyers are now more likely to walk away from the deal rather than negotiate repairs, knowing other properties are available.

This trend underscores the leverage buyers currently hold. They can afford to be more selective and are not hesitating to back out of a contract if the property doesn't meet their expectations or if the total cost of ownership appears too high after initial calculations.

For sellers, this means ensuring their property is in top condition is more important than ever. It also highlights the need for transparent disclosures to avoid deals collapsing after an inspection, which can reset the selling process and add further delays in a market that already favors the buyer.