The American housing market is bracing for a period of significant uncertainty, confronted by a convergence of political promises for radical reform, legal challenges against industry giants, and the stark financial realities of climate change. Homeowners and prospective buyers are navigating a landscape where future federal policy, the stability of major real-estate platforms, and the increasing risk of uninsured natural disasters create a complex and unpredictable environment.

Key Takeaways

- Former President Trump has signaled plans for "aggressive housing reform" to be introduced in 2026, creating policy uncertainty.

- Real estate technology leader Zillow is currently contending with multiple lawsuits and increased competition, raising questions about the stability of the digital marketplace.

- Recent flooding events in Washington state have exposed a critical gap in standard homeowners insurance, which typically does not cover flood damage.

- These distinct pressures from policy, industry, and climate are converging to create a challenging outlook for the U.S. housing sector.

A Shifting Political Landscape

The future of federal housing policy has been cast into uncertainty following recent statements from former President Donald Trump, who teased plans for what he termed “aggressive housing reform” slated for 2026. While specific details of the proposed reforms have not been disclosed, the announcement suggests a potential overhaul of existing housing regulations and initiatives.

This development introduces a significant variable into long-term planning for developers, lenders, and homebuyers. The prospect of sweeping changes could influence investment decisions and market sentiment as stakeholders await concrete proposals. The term "aggressive" implies a departure from incremental adjustments, pointing towards potentially fundamental shifts in federal housing strategy.

In a separate but related development, a bipartisan group of legislators has been working on its own housing package. This effort reflects a cross-party acknowledgment of the nation's housing challenges, though its goals may differ significantly from the reforms hinted at by the former president. The existence of these parallel tracks highlights the contested nature of housing policy moving into the next few years.

Bipartisan Efforts vs. Executive Plans

Current bipartisan discussions in Congress often focus on issues like increasing housing supply, down payment assistance, and zoning reform incentives. An executive-led "aggressive reform" could potentially focus on different areas, such as the role of government-sponsored enterprises like Fannie Mae and Freddie Mac, or a complete rethinking of federal housing subsidies.

Industry Giants Under Pressure

While Washington debates policy, a cornerstone of the modern home-buying experience is facing its own set of trials. Zillow, the digital real estate giant, has found itself navigating a turbulent period marked by lawsuits, public criticism, and the emergence of new competitors. These pressures challenge the company's long-held dominance in the online property search market.

The legal challenges question some of the company's business practices, creating a cloud of uncertainty. Simultaneously, a new wave of potential rivals is working to chip away at its market share, introducing innovative models and technologies. For consumers, the stability of a platform used by millions to find homes, estimate values, and connect with agents is a significant factor in their real estate journey.

Zillow's Market Footprint

Despite recent challenges, Zillow remains a dominant force in the U.S. real estate market. Its websites and apps attract over 200 million average monthly unique users, making its performance a key indicator of the health and direction of the broader PropTech industry.

This period of scrutiny for Zillow is reflective of a broader maturation in the property technology, or "PropTech," sector. After years of rapid growth and disruption, leading companies are now facing the legal and competitive headwinds that often accompany market leadership. The outcome of these challenges could reshape how Americans search for and transact property online.

The Unseen Risk of Climate Change

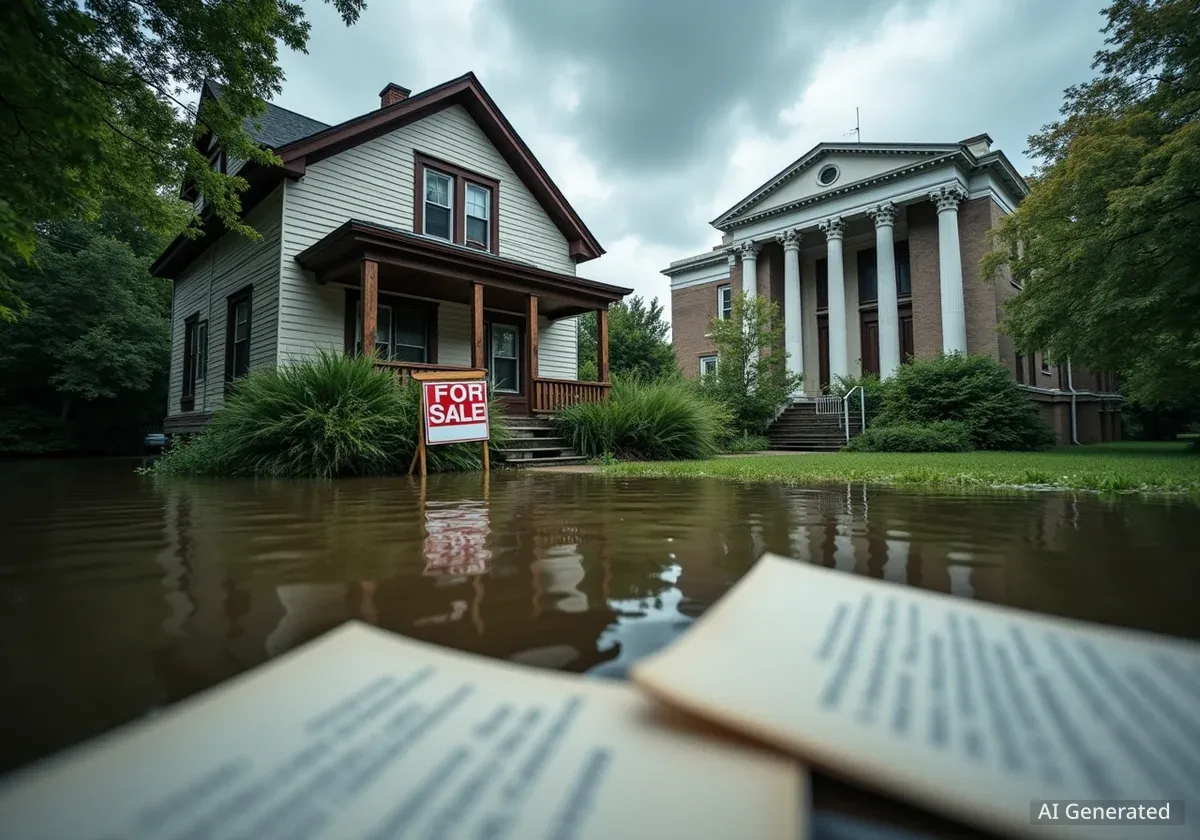

A more immediate and tangible threat has recently materialized for homeowners in Washington state, serving as a cautionary tale for the entire nation. Destructive flooding in the region left many residents discovering a difficult truth: their standard homeowners insurance policies offered no financial protection against the damage.

This is not an issue unique to Washington. Across the country, standard homeowner's insurance explicitly excludes damage from flooding. Protection against this specific peril requires a separate policy, often obtained through the National Flood Insurance Program (NFIP) or a limited number of private insurers. Unfortunately, this crucial distinction is often misunderstood by homeowners until it is too late.

"Many homeowners nationwide operate under the false assumption that their primary insurance policy will cover them in the event of a flood. This coverage gap represents one of the largest uninsured financial risks for American families today."

Closing the Coverage Gap

The recent events highlight a growing crisis at the intersection of climate change and personal finance. As weather patterns become more severe and unpredictable, areas not previously considered high-risk are experiencing unprecedented flooding. This trend increases the urgency for homeowners to reassess their insurance needs.

Financial experts and insurance commissioners are urging property owners to take the following steps:

- Review Your Current Policy: Understand exactly what is and is not covered. Look for specific exclusions related to flooding, earthquakes, and other natural disasters.

- Assess Your Flood Risk: Use FEMA's flood maps and other tools to understand your property's specific risk level, which may have changed over time.

- Seek a Separate Flood Policy: Do not wait for a disaster. Inquire about obtaining a policy through the NFIP or a private carrier. Be aware that there is typically a 30-day waiting period before a new policy takes effect.

The convergence of sweeping policy proposals, instability in the digital real estate sector, and the uninsured risks of a changing climate creates a formidable set of challenges. For millions of Americans, the dream of homeownership is now intertwined with a new set of complex variables that will demand careful navigation in the years to come.