California Firm Buys Distressed Lake Forest Office Complex

A California-based firm has acquired a half-empty office complex in Lake Forest, Illinois, making a significant bet on the suburban Chicago office market.

78 articles tagged

A California-based firm has acquired a half-empty office complex in Lake Forest, Illinois, making a significant bet on the suburban Chicago office market.

Real estate investors are using cost segregation studies to accelerate depreciation deductions, reclassifying building components for faster tax write-offs and boosting cash flow.

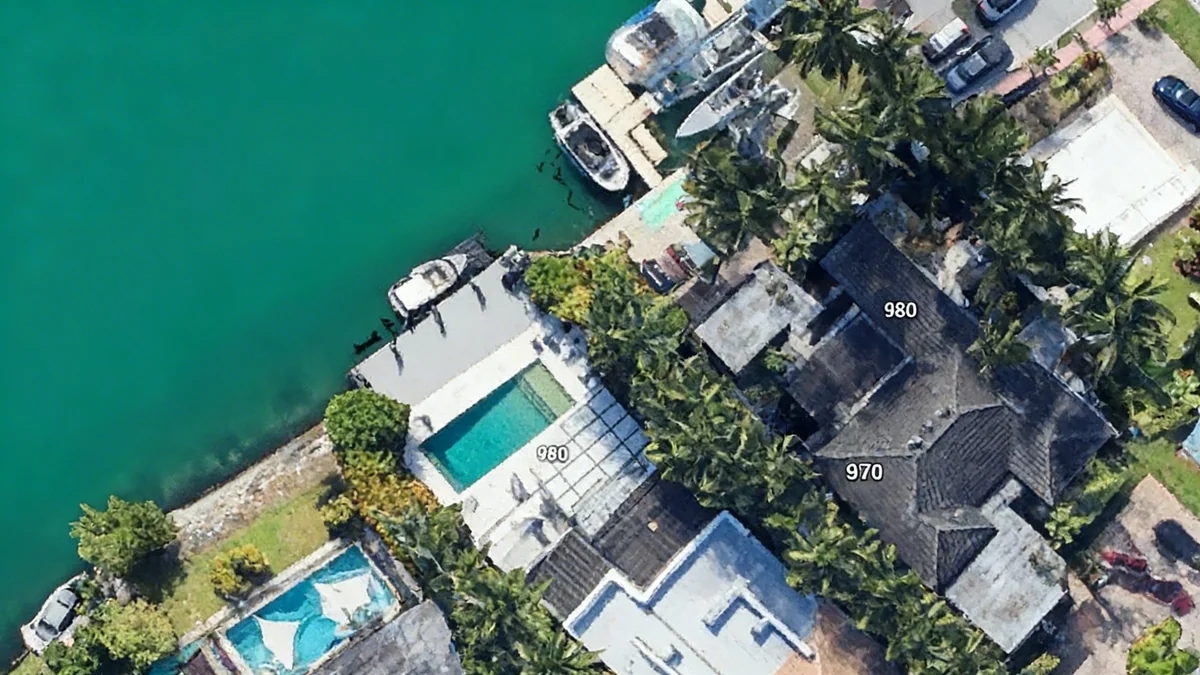

Decorated Olympic skier Lindsey Vonn is as strategic in real estate as she was on the slopes. A look inside her multi-million dollar property portfolio.

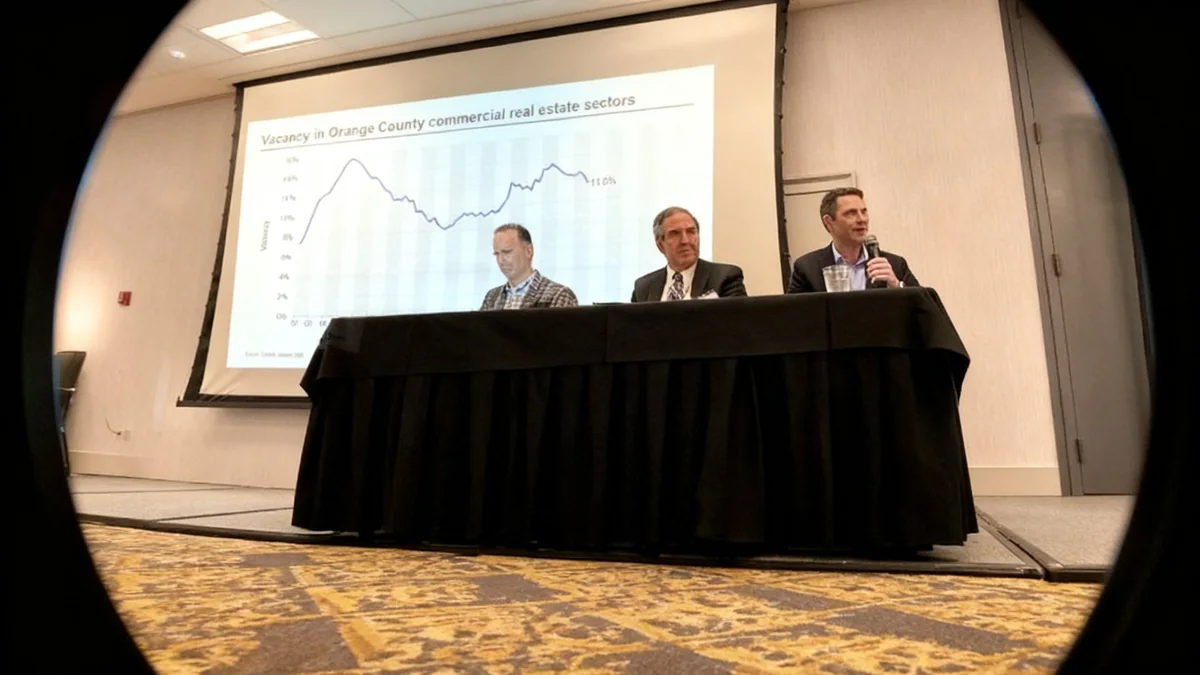

Industry leaders from CoStar and CBRE Inc. convened at Cal State Fullerton’s 2026 Commercial Real Estate Forum to analyze trends in the industrial, retail, office, and multifamily markets.

The multifamily apartment market faces a paradox: weakening rental fundamentals, with rents down 1.4% year-over-year and vacancies at 7.3%, are met with rising investor demand.

US commercial real estate deal volume grew 17% in 2025, a sign of steady stabilization despite economic pressures. Multifamily, office, and data center sectors led the recovery.

A wave of maturing debt, totaling trillions of dollars, is creating significant pressure on the commercial real estate market, leading to falling property values.

Investors from Texas are acquiring major commercial real estate in San Francisco, signaling renewed confidence in a market recovering from a multi-year downturn.

Denver's commercial real estate market is buzzing with activity, highlighted by a $7.66 million hotel sale and new restaurants coming to FlatIron Crossing.

A local developer has purchased a 10-property portfolio in Richmond's historic Fan district for $7.6 million, a deal that includes several iconic buildings.

Kanye West's former Malibu home is now a fractional real estate asset, allowing investors to buy memberships for access and equity. The new owner plans to transform the Tadao Ando-designed property in

Chad Tredway, global head of JPMorgan's real estate investment business, sees a significant shift of investor capital from equities into property. He leads a $79 billion portfolio, prioritizing indust