Newport Coast Dethrones Fisher Island as Priciest US ZIP Code

Newport Coast, California, has been named the most expensive ZIP code in the U.S. with a median list price of $12.5 million, surpassing Fisher Island, Florida.

Samuel Holloway is a senior correspondent for Crezzio covering commercial real estate and institutional investment. He specializes in large-scale transactions, market analysis, and the strategies of major private equity firms in the property sector.

Portfolio

Newport Coast, California, has been named the most expensive ZIP code in the U.S. with a median list price of $12.5 million, surpassing Fisher Island, Florida.

French luxury house Hermès has been identified as the buyer behind a record-setting $400 million real estate deal on Beverly Hills' famed Rodeo Drive.

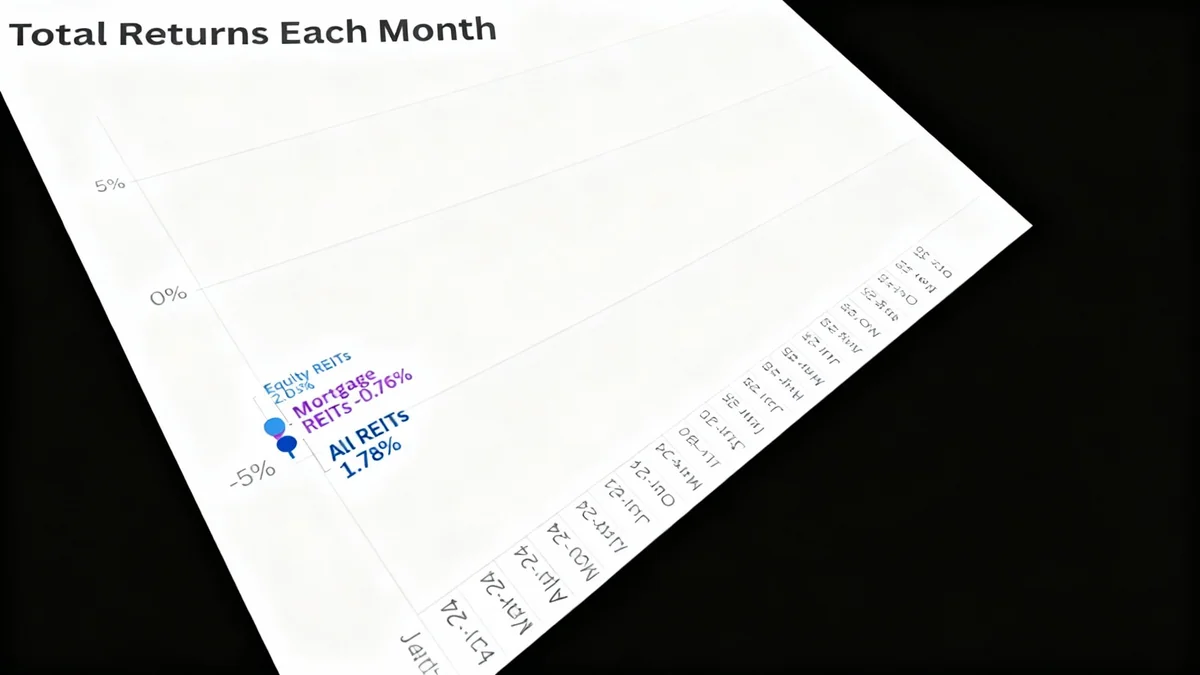

US commercial real estate deal volume grew 17% in 2025, a sign of steady stabilization despite economic pressures. Multifamily, office, and data center sectors led the recovery.

Apollo Commercial Real Estate Finance (ARI) has agreed to sell its $9 billion loan portfolio to Athene, an affiliated insurer, at a price near its book value.

Private equity firm EQT AB is planning a major expansion of its real estate division, CEO Per Franzen announced, aiming to scale the business beyond its top-10 global ranking.

Australian property prices have hit record highs in most capital cities, with Perth becoming the sixth city to record a median house price over $1 million.

US commercial real estate transactions fell 10% in November, dipping below 2020 levels. However, deals over $100 million surged 51% as investors target premium assets.

A wave of maturing debt, totaling trillions of dollars, is creating significant pressure on the commercial real estate market, leading to falling property values.

The U.S. housing market is showing clear signs of balancing, as more agents report stable conditions and sellers increasingly cut prices to meet buyer realities.

New York City's famed narrowest house sells for $4.4 million, headlining a day of real estate deals totaling $314 million across the five boroughs.

British Columbia's latest property assessments reveal a major split, with values falling in the Lower Mainland while rising in many northern and interior regions.

Japanese beverage giant Sapporo Holdings is reportedly finalizing a $2.6 billion deal to sell its real estate division, including the iconic Yebisu Garden Place.

A complex financing method known as 'back leverage' is rapidly growing in European real estate, allowing banks to fund major projects while raising new concerns about market risk.

Fernando de Leon, an investor who successfully navigated the 2008 financial crisis, is now raising concerns about the long-term viability of the booming data center market.

Private equity giant Blackstone has used a creative £632 million deal, taking a stake in the buyer, to offload UK warehouses, signaling a major shift in real estate.

The U.S. is short 4 million homes, and private equity firms are buying them up. We explore how institutional investors are impacting the housing market.

A 252-acre plot of farmland in Madison County, Ohio, was sold for $81.8 million, nearly ten times the price it was purchased for just one year prior.

While investors chase massive returns in AI stocks, some analysts argue that the beaten-down commercial real estate sector is now a fairly priced safe haven.

A convergence of aging populations and evolving medical practices is transforming healthcare real estate from a niche market into a core investment for institutional investors.

A new 420-unit apartment community, Resia Golden Glades, has officially opened in North Miami, marking the first completed project for a major international fund.