Expert's Advice for Navigating the Housing Market

With mortgage rates falling, financial expert Dave Ramsey advises homebuyers to choose 15-year loans and limit housing costs to 25% of their take-home pay.

20 articles tagged

With mortgage rates falling, financial expert Dave Ramsey advises homebuyers to choose 15-year loans and limit housing costs to 25% of their take-home pay.

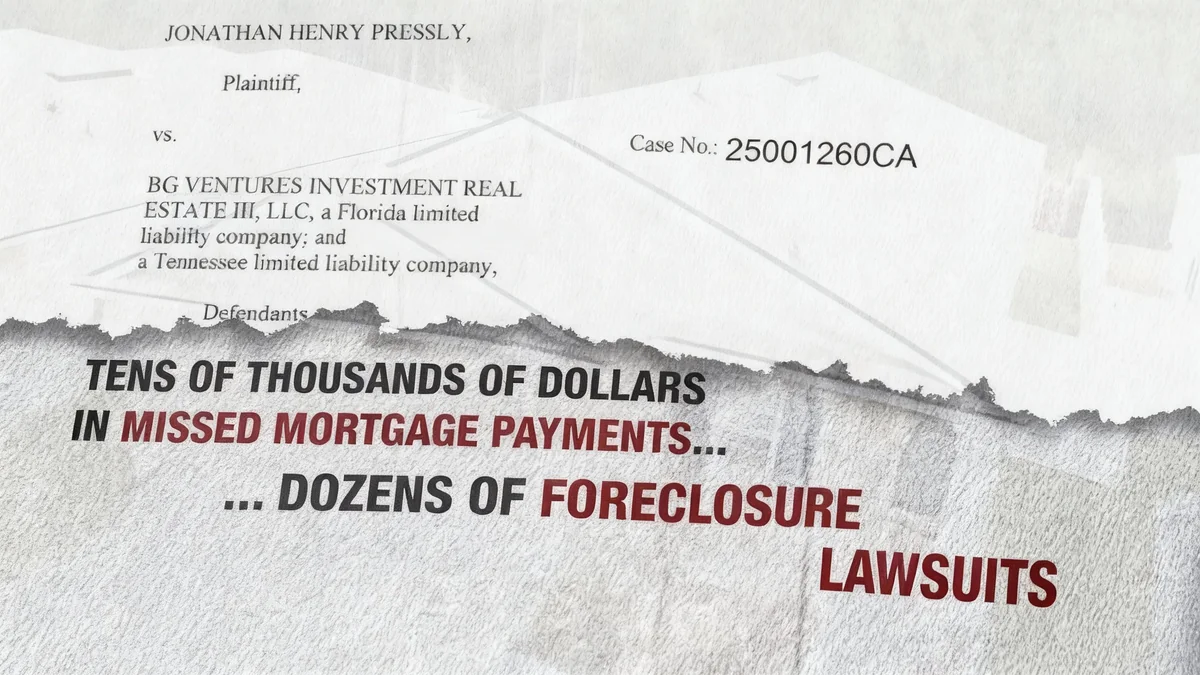

Dozens of Florida homeowners are facing foreclosure after a real estate investment firm allegedly defaulted on payments in risky 'subject-to' mortgage deals.

Kansas lawmakers are reviewing a bill that would permit lenders to charge prepayment penalties on mortgages for investment properties, a move supporters say would offer investors more financing option

As home prices soar, the 50-year mortgage is being debated as a solution. Experts warn of minimal monthly savings, massive interest costs, and dangerously slow equity growth.

New data reveals a record 40.3% of U.S. homeowners now own their homes without a mortgage, a trend driven primarily by the aging Baby Boomer generation.

Mortgage lenders can legally ask about immigration status but cannot discriminate based on national origin. Learn the difference and what to do if you feel targeted.

Mortgage lender Lower has announced a major strategic partnership with real estate brokerage HomeSmart, gaining access to a network of 25,000 agents nationwide.

The real estate industry is navigating significant legal challenges, leadership transitions, and concerns over government policy impacting the housing market.

Rocket Companies is executing a major strategic pivot, acquiring Redfin and Mr. Cooper Group to build a resilient, integrated homeownership platform.

Key leadership changes are underway at HomeSmart, NAMB, and the MBA, while Zillow and Redfin face a growing antitrust lawsuit now backed by five states.

In South Florida's high-cost housing market, some buyers are using assumable mortgages to take over sellers' low-interest loans, saving thousands on monthly payments.

Financial experts advise treating real estate as a long-term strategy for building wealth, not a get-rich-quick scheme, focusing on steady equity growth.